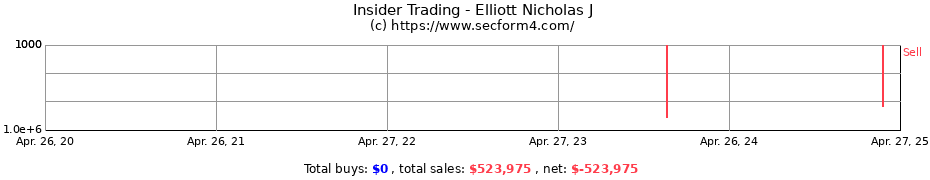

Real time insider trading transaction history:

- Insiders are prohibited from making short-swing profits by trading their shares within 6 months of the registration or acquiring the shares.

- Shares are not adjusted for stock split.

"Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise"

- Peter Lynch

What is insider trading>>

- Peter Lynch

What is insider trading>>

Common stock purchase or sale:

| Transaction Date |

Reported DateTime |

Company | Symbol | Insider Relationship |

Shares Traded |

Average Price |

Total Amount |

Shares Owned |

Filing |

| 2025-03-20 Sale |

2025-03-24 4:03 pm |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

300 | $502 | $150,600 | 33,641 (Indirect Direct) |

View |

| 2023-12-14 Sale |

2023-12-18 4:15 pm |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

725 | $515 | $373,375 | 15,066 (Indirect Direct) |

View |

Stock options: Exercise, Award, Grant, Conversion

| Transaction Date |

Reported DateTime |

Exercisable Expiration |

Company | Symnbol | Insider Relationship |

Shares Traded |

Conversion Price |

Shares Owned |

Filing |

| 2025-01-23 Tax Withholding |

2025-01-27 4:03 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

214 | $524.14 | 33,937 (Direct) |

View |

| 2024-12-03 Option Award |

2024-12-05 4:12 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

18,373 | $0 | 34,151 (Direct) |

View |

| 2024-01-23 Option Award |

2024-01-25 4:06 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

700 | $0 | 15,768 (Direct) |

View |

Ownership |

2023-08-14 4:11 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | Elliott Nicholas J Chief Alignment Officer |

0 | $0 | 15,787 (Direct) |

View |