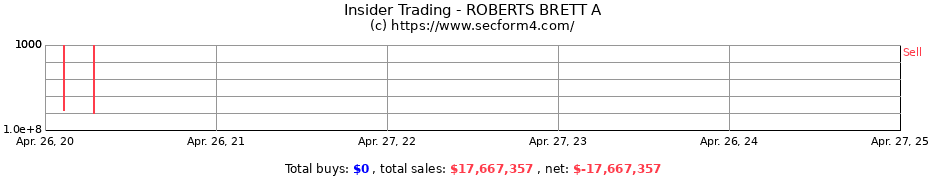

Real time insider trading transaction history:

- Insiders are prohibited from making short-swing profits by trading their shares within 6 months of the registration or acquiring the shares.

- Shares are not adjusted for stock split.

"Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise"

- Peter Lynch

What is insider trading>>

- Peter Lynch

What is insider trading>>

Common stock purchase or sale:

| Transaction Date |

Reported DateTime |

Company | Symbol | Insider Relationship |

Shares Traded |

Average Price |

Total Amount |

Shares Owned |

Filing |

| 2020-08-07 Sale |

2020-08-11 4:03 pm |

CREDIT ACCEPTANCE CORP | CACC | ROBERTS BRETT A Chief Executive Officer |

21,036 | $512.47 | $10,780,228 | 416,011 (Direct) |

View |

| 2020-06-05 Sale |

2020-06-09 4:16 pm |

CREDIT ACCEPTANCE CORP | CACC | ROBERTS BRETT A Chief Executive Officer |

14,476 | $475.76 | $6,887,129 | 437,047 (Direct) |

View |

Stock options: Exercise, Award, Grant, Conversion

| Transaction Date |

Reported DateTime |

Exercisable Expiration |

Company | Symnbol | Insider Relationship |

Shares Traded |

Conversion Price |

Shares Owned |

Filing |

| 2021-03-01 Tax Withholding |

2021-03-03 4:05 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | ROBERTS BRETT A Chief Executive Officer |

4,910 | $378.48 | 451,101 (Direct) |

View |

| 2021-01-29 Option Award |

2021-02-02 4:09 pm |

N/A N/A |

CREDIT ACCEPTANCE CORP | CACC | ROBERTS BRETT A Chief Executive Officer |

40,000 | $0 | 456,011 (Direct) |

View |